RBI will have to cut CRR to ease banking liquidity; Mahakumbh leads to significant cash withdrawals: SBI Report

ANI

04 Mar 2025, 12:44 GMT+10

New Delhi [India], March 4 (ANI): The Reserve Bank of India (RBI) will have to cut the Cash Reserve Ratio (CRR) to ease the prevailing liquidity pressure in the banking sector, according to a report by State Bank of India (SBI) research.

The report highlighted that with unchanged ownership in government securities (G-secs) in the financial year 2025-26 (FY26), the Open Market Operations (OMO) gap could still be around Rs 1.7 trillion. This suggests that additional liquidity measures may be required on a sustained basis.

It said 'Liquidity Estimation; CRR cut is necessary to ease the pressure, RBI could look into using CRR more as a regulatory intervention tool / countercyclical liquidity buffer rather than as a liquidity tool in future'.

According to the report, RBI should explore using CRR more as a regulatory intervention tool or a countercyclical liquidity buffer, rather than relying on it as a liquidity tool in future.

The current liquidity conditions, combined with the projected OMO gap, underline the necessity of proactive measures to maintain stability in the financial system.

The report also called for a reassessment of RBI's existing liquidity management framework. It suggested replacing the Weighted Average Call Rate (WACR) as the policy rate, arguing that it does not effectively serve its intended purpose.

The current framework, according to the report, may need modifications to align with evolving market conditions and liquidity requirements.

The Indian banking system's liquidity has seen its worst liquidity crunch of more than a decade. The system liquidity moved from a surplus of Rs 1.35 lakh crore in November to a deficit of Rs 0.65 lakh crore in December, further to Rs 2.07 lakh crore deficit in January and Rs 1.59 lakh crore in February.

Additionally, the report pointed out an inadvertent cash leakage due to Mahakumbh, a major religious event.

The report says that during Mahakumbh a significant portion of cash withdrawals were made by retail depositors, whereas fresh deposit accretions have come from non-retail participants.

As a result, a substantial part of the withdrawn currency may not return to systemic deposits, at least until the end of March.

With these factors in mind, the report highlighted the urgency for RBI to take proactive steps to address liquidity concerns. A CRR cut, it said, would provide immediate relief and help stabilize banking system liquidity, ensuring smoother financial operations in the coming months. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of India Gazette news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to India Gazette.

More InformationBusiness

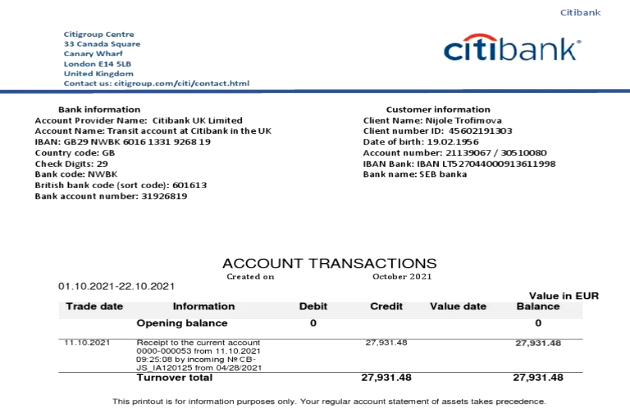

SectionCitigroup mistakenly credits $81 trillion to customer instead of $280

NEW YORK CITY, New York: A routine banking transaction at Citigroup last April turned into a major blunder when the bank mistakenly...

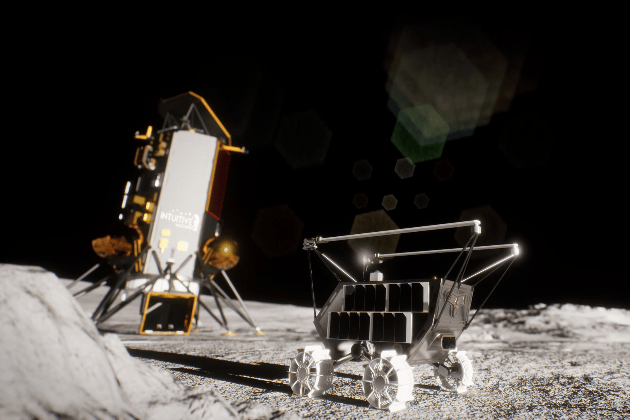

Intuitive Machines launches rocket for moon’s south pole mission

CAPE CANAVERAL, Florida: A new private lunar mission is on its way to the moon, as Intuitive Machines launched its second lander, Athena,...

Gatwick set for second runway as UK greenlights expansion

LONDON, U.K.: The UK government has tentatively approved the expansion of Gatwick Airport, paving the way for a second runway, drawing...

North Korean-backed hackers steal $1.5 billion from Dubai crypto firm

ROME, Italy: U.S. authorities have accused North Korean-backed hackers of stealing US$1.5 billion in cryptocurrency from Dubai-based...

Hong Kong promotes AI to offset 10,000 civil service job cuts

HONG KONG: Hong Kong is set to cut 10,000 civil service jobs and freeze public sector salaries as part of a cost-cutting initiative...

Alibaba releases AI model Wan 2.1 to the public

BEIJING, China: Alibaba has made its video- and image-generating AI model, Wan 2.1, publicly available, marking a significant step...

Delhi

SectionMP CM Mohan Yadav says Govt will build entry gates in Bhopal and name them after Raja Bhoj, Vikramaditya

Bhopal (Madhya Pradesh) [India], March 4 (ANI): Madhya Pradesh Chief Minister Mohan Yadav on Tuesday announced that his government...

PM Modi inaugurates Vantara in Jamnagar, feeds lion cubs, giraffes

Jamnagar (Gujarat) [India], March 4 (ANI): Showing his love and affection for animals, Prime Minister Narendra Modi recently inaugurated...

RBI will have to cut CRR to ease banking liquidity; Mahakumbh leads to significant cash withdrawals: SBI Report

New Delhi [India], March 4 (ANI): The Reserve Bank of India (RBI) will have to cut the Cash Reserve Ratio (CRR) to ease the prevailing...

"Such statements are unacceptable": Keshav Maurya urges Akhilesh to take action against Abu Azmi over remarks on Aurangzeb

Lucknow (Uttar Pradesh) [India], March 4 (ANI): In response to Samajwadi Party Maharashtra MLA Abu Azmi's controversial remarks about...

Maharashtra Deputy CM has no knowledge of history: Samajwadi Party MP Awadhesh Prasad

New Delhi [India], March 4 (ANI): Samajwadi Party MP Awadhesh Prasad on Tuesday criticized Maharashtra Deputy Chief Minister Eknath...

"Nothing but distortion of history": BJP's N Ramchander Rao over Abu Azmi's remarks on Aurangzeb

Hyderabad (Telangana) [India], March 4 (ANI): After Samajwadi Party leader Abu Azmi's remarks on Mughal ruler Aurangzeb erupted a row,...