Indian banks expected to see loan growth of 12-14 per cent in FY26: Report

ANI

31 Mar 2025, 09:03 GMT+10

New Delhi [India], March 31 (ANI): Indian banks are expected to register loan growth of 12-14 per cent in the financial year 2025-26 (FY26), driven by an increase in deposit inflows, according to a report by Ambit Capital Research.

The report highlighted that the banking sector has started seeing some relief in loan-to-deposit ratios (LDRs) after facing challenges related to liquidity and asset quality. This improvement is mainly due to a gradual rise in deposits and a slower pace of loan disbursements.

Experts believe that this trend will be reflected in the period-end LDR as well. Additionally, easing liquidity conditions and a possible reduction in risk weights on unsecured retail loans are expected to support steady loan growth.

It said 'With easing liquidity and probable easing of risk weights on unsecured retail, we expect sector loan growth to stay at 12-14 per cent in FY26E'.

Despite improving liquidity, the report mentioned that the banks are likely to face pressure on their net interest margins (NIMs) in FY26. The reason for this is high deposit costs and falling yields, which could lead to a decline of 5-20 basis points for most lenders.

However, the impact will vary depending on a bank's portfolio mix and liability structure. Banks with a higher share of fixed-rate loans will likely manage their margins better than those with a greater proportion of variable-rate loans.

The report also pointed out a rise in non-performing assets (NPAs) in the retail sector due to an increase in unsecured retail loans such as personal loans and credit cards. While banks had maintained strong asset quality post-COVID, the growing volume of unsecured loans has led to higher retail defaults in recent years.

To address this issue, banks have started consolidating their retail lending portfolios, which will help them identify and manage balance sheet stress by the first half of FY26.

Although credit costs are expected to rise in FY26, banks have built strong provisions ranging from 0.7-1.7 per cent of total loans. The provision coverage ratio (PCR) remains at around 70%, which should provide some cushion against potential defaults.

With liquidity conditions improving and possible regulatory support, such as a reduction in risk weights on unsecured retail loans, the banking sector is expected to grow steadily. However, banks will need to manage deposit costs, margin pressures, and asset quality challenges to maintain financial stability in FY26. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of India Gazette news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to India Gazette.

More InformationBusiness

SectionBYD aims to double overseas EV sales to 800,000 in 2025

SHANGHAI, China: As global demand for electric vehicles continues to rise, China's BYD is looking to double its overseas sales to over...

To meet US AI energy surge, Schneider Electric invests $700 million

ANDOVER, Massachusetts: As artificial intelligence drives up energy demand across the United States, Schneider Electric is making a...

Americans grow gloomy on finances as confidence declines further

WASHINGTON, D.C.: U.S. consumer confidence continued to drop in 2025, hitting its lowest level in 12 years as more Americans worry...

Waymo gears up for driverless expansion in Washington, D.C.

WASHINGTON, D.C.: Alphabet's self-driving division Waymo is preparing to expand its driverless ride-hailing footprint to the heart...

Regulatory win in India paves way for Starlink's expansion

BENGALURU, India: A major regulatory breakthrough in India could mark a turning point for Starlink, Elon Musk's satellite internet...

U.S. stocks plummet on Trump trade policies, techs worst hit

NEW YORK, New York - Renewed fears about inflation, and U.S. Donald Trump's trade policies say American markets take a deep dive Friday....

Delhi

SectionRegulatory win in India paves way for Starlink's expansion

BENGALURU, India: A major regulatory breakthrough in India could mark a turning point for Starlink, Elon Musk's satellite internet...

Indian banks expected to see loan growth of 12-14 per cent in FY26: Report

New Delhi [India], March 31 (ANI): Indian banks are expected to register loan growth of 12-14 per cent in the financial year 2025-26...

Reformation, performance, and transformation are leading state: Arunachal CM

West Kameng (Arunachal Pradesh) [India], March 31 (ANI): Arunachal Pradesh Chief Minister Pema Khandu said at a developmental meeting...

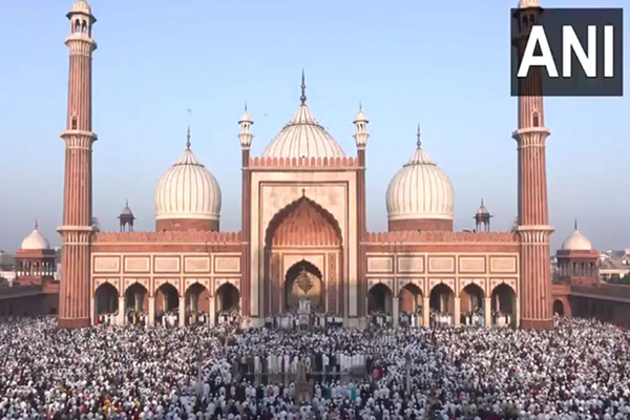

Muslims across India celebrate Eid-ul-Fitr, marking the end of Ramzan

New Delhi [India], March 31 (ANI): The crescent moon signalled the end of Ramzan the night before, and millions of Muslims across the...

PM Modi to inaugurate Jammu-Srinagar Vande Bharat train on April 19 from Katra: Jitendra Singh

Udhampur (Jammu and Kashmir) [India], March 31 (ANI): Union Minister Jitendra Singh has announced that Prime Minister Narendra Modi...

Delhi: Morning Aarti held at Jhandewalan temple on second day of Navratri

New Delhi [India], March 31 (ANI): The morning Aarti was held at Jhandewalan Temple in New Delhi on the second day of the nine-day-long...