How Jane Street Group manipulated derivatives to earn illegal profits: Experts decode SEBI's Rs 4,843 crore chase

ANI

04 Jul 2025, 14:34 GMT+10

By Nikhil Dedha

Mumbai (Maharashtra) [India], July 4 (ANI): In a major development, the Securities and Exchange Board of India (SEBI) has passed an interim order against the Jane Street Group, to impound Rs 4,843.57 crore of illegal gains by manipulating the securities market, particularly on expiry days of Bank Nifty options.

ANI spoke with various experts to decode the trading strategy adopted by JS group to make undue and illegal profit from market movements at the cost of retail investors.

Speaking to ANI, Uttam Bagri, Managing Director of BCB Brokerage, explained that Jane Street followed a strategy that misused the connection between the cash and derivatives segments.

'What they did was, in the cash segment, they kept taking strong long positions. At the same time, in the derivatives segment, they were going short, with a much larger position,' Bagri said.

In simple language, the whole trading pattern of the Jane Street group can be explained as follows.

In a small village, there was a market for Curd and Lassi. Their prices are linked. High Frequency Traders (HFTs) like Jane Street Group in the morning used their Financial Muscle to corner the market and move the prices higher. The Lassi prices moved higher in tandem. In the afternoon, they started selling options on Lassi at much higher prices and buying options on curd at prices much lower than the current market price.

Street, looking at a steady upmove in curd prices, sold put options at lower prices at very little premium. In the late afternoon, HFTs started dumping curd at throwaway prices, bringing down lassi prices.

The seller of put options suffered huge losses. HFT did suffer some loss on the sale of curd, but made far more money on the buying of lassi put option.

SEBI's order also noted that the group accumulated long positions in the cash market and created the impression of strong buying interest.

Meanwhile, they silently built massive short positions in the derivatives market. Later in the day, they suddenly start selling off their long positions in the cash market. This sharp sell-off pulled prices down, and because they had taken large short positions in the derivatives market, they profited big when prices fell against minor losses in the cash market.

Bagri said, 'This strategy gave them huge profits in the derivatives segment, even though they might have faced losses in the cash segment. The net result was a significant profit due to market movement caused by their trades'.

SEBI's interim order marks one of the biggest actions taken against market manipulation in recent years and raises questions about the role of sophisticated players in India's capital markets.

SEBI has also pointed out that this trading behaviour affected the closing prices of stocks, particularly on options expiry days. The group allegedly took massive positions in the derivatives segment and made aggressive trades in the cash segment during the final trading hours to push the index in a specific direction.

This movement helped them benefit from the expiry of options contracts, leading to even higher gains.

Bagri said that this method of trading falls under market manipulation. 'The cash market has fewer players, so these large trades easily influence price movement. SEBI believes this is not fair or proper,' he said.

When asked why SEBI passed an interim order, Bagri said, 'SEBI wants to send a strong message. Whether you're a small trader or a large global player, if you manipulate the market, they will take action. This order reinforces that message.'

SEBI has also held the group liable 'jointly and severally.' This means all the involved entities or individuals are equally responsible for the entire Rs 4,843-crore gain, and none can escape accountability.

Explaining the impact on retail investors, Bagri added, 'Market participants accept risks related to the economy, politics or other external events. But manipulation risk is not acceptable. When prices are being influenced by unfair means, it's a danger to market integrity.'

For retail investors, Bagri advised that 'Don't rely on tips or follow market hype blindly. If you're confident, study the market yourself. Otherwise, take advice, whether it's from mutual fund managers, stockbrokers, certified investment advisors, or trusted professionals like chartered accountants. But make sure the advisor is legitimate and understands your interests. Most people overestimate their market knowledge. My advice is: choose your advisor wisely'.

Speaking with ANI, Nilesh Shah, Managing Director of Kotak Mahindra Asset Management Company, noted, 'High-frequency traders (HFTs) have powerful tools like algorithms, superior data and massive financial muscle. This gives them the power to make large intraday bets and move the markets. A recent study showed that 9 out of 10 participants in F&O lose money. HFTs are among the few making billions every year from Indian markets.'

Though Shah refrained from commenting on the legal aspects of the SEBI order, he emphasised the need for a fair and level playing field.

SEBI's interim order marks one of the biggest actions taken against market manipulation in recent years and raises questions about the role of sophisticated players in India's capital markets. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of India Gazette news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to India Gazette.

More InformationBusiness

SectionGrammarly acquires Superhuman to boost AI workplace tools

SAN FRANCISCO, California: Grammarly is doubling down on AI-powered productivity tools with the acquisition of Superhuman, a sleek...

Standard and Poor's 500 and and Nasdaq Composite close at record highs

NEW YORK, New York -U.S. stock markets closed with broad gains on Thursday, led by strong performances in U.S. tech stocks, while European...

Persson family steps up H&M share purchases, sparks buyout talk

LONDON/STOCKHOLM: The Persson family is ramping up its investment in the H&M fashion empire, fueling renewed speculation about a potential...

L'Oreal to buy Color Wow, boosts premium haircare portfolio

PARIS, France: L'Oréal is making a fresh play in the booming premium haircare segment with a new acquisition. The French beauty conglomerate...

Robinhood launches stock tokens for EU investors, adds OpenAI

MENLO PARK, California: Robinhood is giving European investors a new way to tap into America's most prominent tech names — without...

Wall Street diverges, but techs advance Wednesday

NEW YORK, New York - U.S. stocks diverged on Wednesday for the second day in a row. The Standard and Poor's 500 hit a new all-time...

Delhi

SectionUN offer rejected in Dreamliner crash investigation

NEW DELHI, India: India has decided not to allow a United Nations (UN) investigator to join the investigation into the recent Air India...

How Jane Street Group manipulated derivatives to earn illegal profits: Experts decode SEBI's Rs 4,843 crore chase

By Nikhil Dedha Mumbai (Maharashtra) [India], July 4 (ANI): In a major development, the Securities and Exchange Board of India (SEBI)...

Kerala: BJP stages protest march to Health Minister's house over woman's death at Kottayam Medical College

Thiruvananthapuram (Kerala) [India], July 4 (ANI): Kerala Police used water cannons to disperse BJP workers who staged a protest march...

"He is already a future star": Mohammad Azharuddin hails Shubman Gill after his double ton

Hyderabad (Telangana) [India], July 4 (ANI): Former India cricketer Mohammad Azharuddin lauded Test captain Shubman Gill and called...

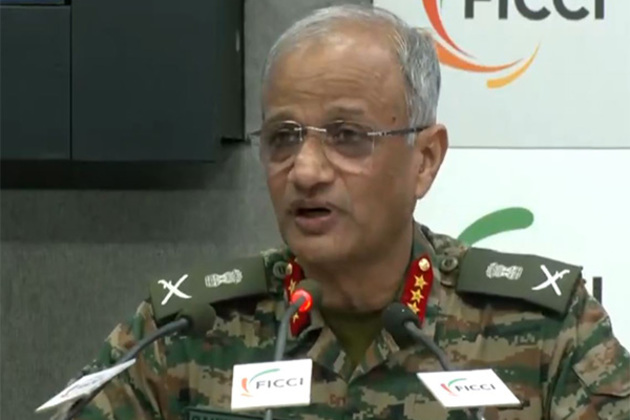

"China provided all support to Pakistan." Deputy COAS reveals Pak-China tango during Op-Sindoor

New Delhi [India], July 4 (ANI): Deputy Chief of Army Staff (Capability Development and Sustenance), Lieutenant General Rahul R Singh,...

PNGRB approves pivotal reforms in natural gas pipeline tariff regulations

New Delhi [India], July 4 (ANI): In a decisive move aimed at strengthening India's transition towards a cleaner, more efficient energy...